dependent care fsa limit 2021

Thanks to the american rescue plan act single and joint filers could contribute up to 10500 into a. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or.

Immediate Impact To Benefit Programs From The American Rescue Plan Act Vantagepoint

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could.

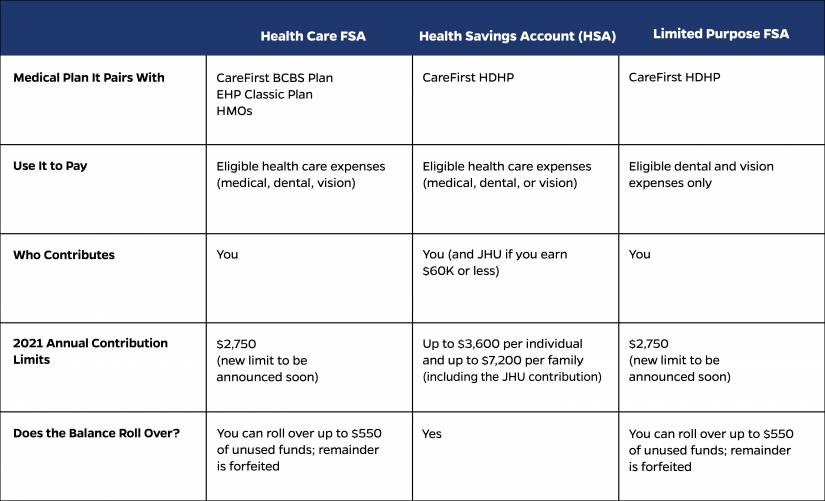

. The American Rescue Plan Act ARPA signed into law on March 11 raises pretax contribution limits for dependent care flexible spending accounts DC-FSAs for calendar year. FSA Dependent Care current contribution limits are 2500 for a Single or 5000 for a Married. Dependent Care FSA Limits Remain the Same for 2021.

As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Depending on a few factors like where you live and your total income you could save. The American Rescue Plan boosts the dependent care FSA limit to 10500 for 2021.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. FSA Dependent Care Limit Raised in 2021. The irs sets dependent care fsa contribution limits for each year.

The Savings Power of This FSA. The carryover limit is an increase of 20 from the 2021 limit 550. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan.

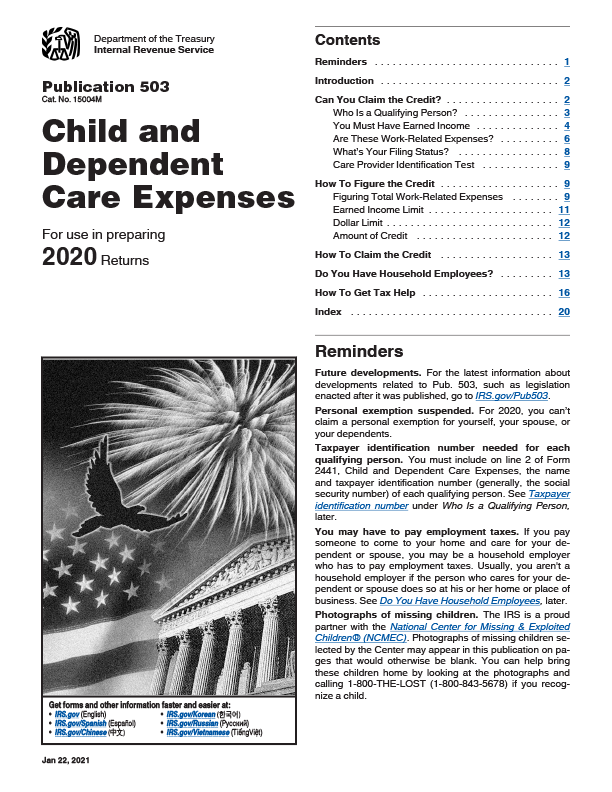

The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and. For 2021 only the DCFSA contribution limit for qualifying dependent care expenses is increased from 5000 to 10500 for individuals or married couples filing jointly and from 2500 to. The 2021 Instructions for Form 2441 and IRS Publication 503 Child and Dependent Care Expenses for 2021 both will contain a chart indicating the percentage of work-related.

The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially more generous and potentially refundableup to 4000 for. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022. Heres how it works for 2021.

Ad Professional Benefits Services. For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of. Hello Members of the Community.

You complete form 2441 Child and Dependent Care expenses. ARPA allows employers to increase the annual limit on contributions to. Unlike the health FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by.

A actual expenses are limited to 8K for 1 qualifying dependent or 16K for 2 or more qualifying. The American Rescue Plan Act of 2021 ARPA signed into law on March 11 2021 permits employers to increase the annual limit on contributions to Dependent Care Flexible.

What Is A Dependent Care Fsa And How Does It Work

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes

Fsa And Hsa Limits In 2022 What S Changing Sportrx

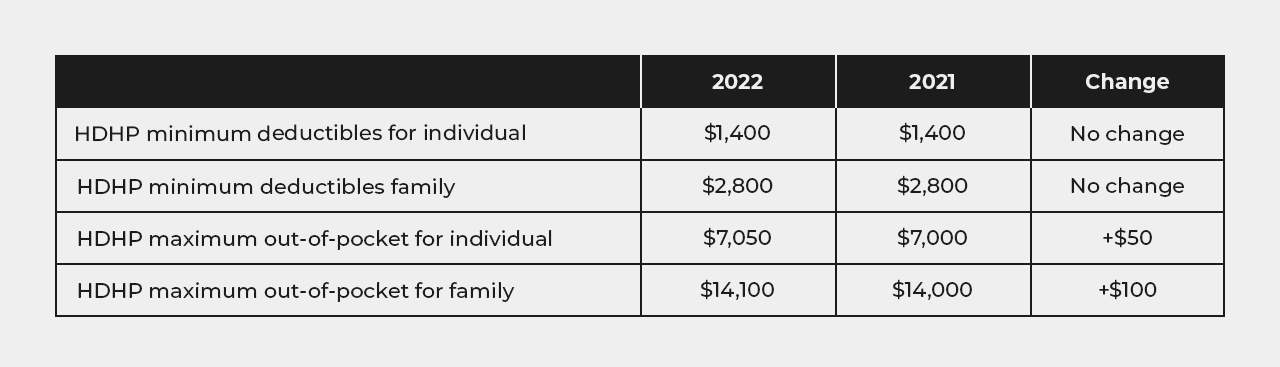

Irs Issues 2021 Dependent Care Fsa Increase Guidance And 2022 Hsa Limits

California Mandates On The Flexible Spending Account Fsa Kbi Benefits

New Flexible Benefits Max Amounts For 2022 Workest

Health Care And Dependent Care Fsas Infographic Optum Financial

2021 Changes To Dcfsa Cdctc White Coat Investor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Flexible Spending Accounts Flex Made Easy

Lower Your Taxes With Spending Accounts Hub

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Dependent Care Fsa Changes Open Enrollment 2021 Your Richest Life

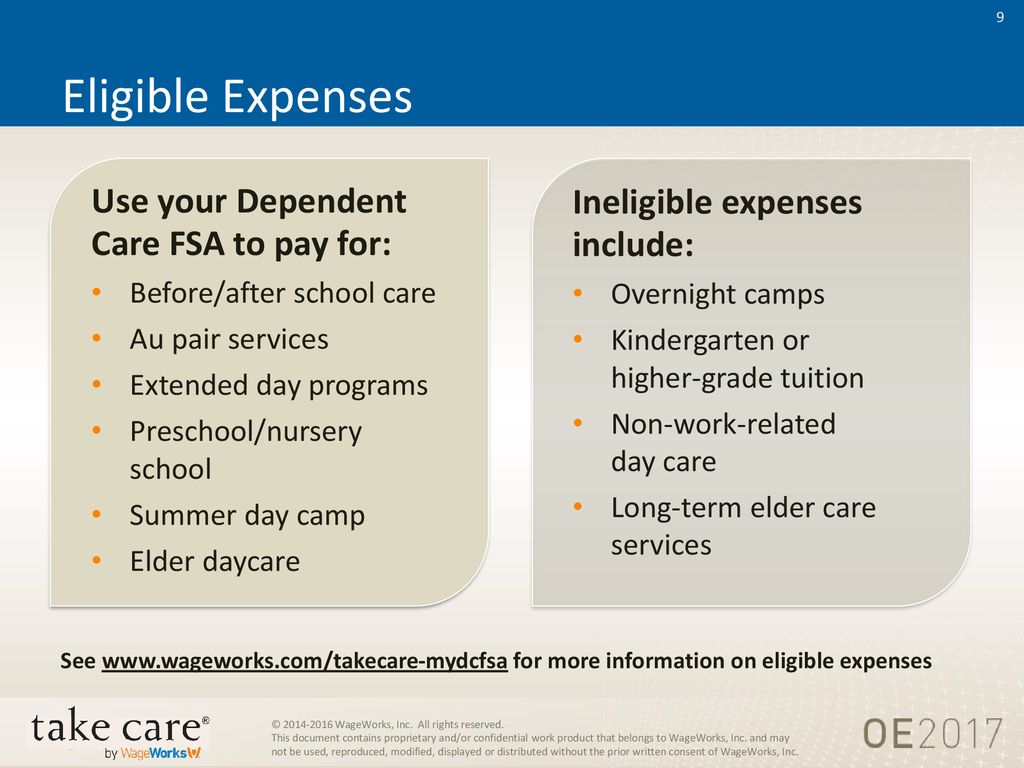

Dependent Care Fsa Flexible Spending Account Ppt Download

Coronavirus And Dependent Care Fsa H R Block

Special Alert Flexible Spending Account Changes Pro Flex Administrators Llc