do you pay california state taxes if you live in nevada

The state of California requires residents to pay personal income taxes but Nevada does not. The other answers are OK from a theoretical basis.

Sales Taxes In The United States Wikipedia

Ashley Quinn CPAs and Consultants Ltd.

. Is particularly experienced in the tax rules and planning aspects of relocation from California to Nevada and can help you evaluate your potential for. The state of California requires residents to pay personal income taxes but Nevada does not. Even where California agrees that you moved they might not agree when you moved.

If you hold residency in California you typically must pay California income taxes even if you earn your living in Nevada. In other words nonresidents pay California income taxes on taxable California-source income. The state of California requires residents to pay personal income taxes but Nevada does not.

If you hold residency in California you typically must pay California income. 79 and in Nevada its. The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west.

If you hold residency in California you typically must pay California income taxes even if you. The second rule is that California will tax income generated in the state regardless of where you live. Like in California different cities and municipalities often add in local sales taxes.

If you hold residency in California you typically must pay California income. That means Californians pay. When it comes to property tax Nevada and California boast similar rates.

With respect to employees the source of income from services compensated. Therefore depending on your total income you. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of.

Hi Even though you live in Nevada which has no state income tax any income you earn in the state of California is taxable to California as California source income. In short Nevada has no state incomes tax. But we are dealing with California here and the FTB Franchise Tax Board which is like the IRS for California is.

So if you own California real estate but live in New York you still have to pay California. However even though you do not live in California you still must pay tax on income earned in California as a nonresident. In California the effective property tax rate is.

Californias Franchise Tax Board administers the. Whether youre a doctor teacher real estate agent or entertainer you do not have to pay any state taxes on your earnings in Nevada. This federal law prohibits any state from taxing pension income of non-residents even if the pension was earned within the state.

After all Californias 133 tax on capital gains inspires plenty of tax moves. The state of California requires residents to pay personal income taxes but Nevada does not. Answer 1 of 6.

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

2022 Property Taxes By State Report Propertyshark

Moving Avoids California Tax Not So Fast

Sales Tax By State Is Saas Taxable Taxjar

Treasurer Tax Collector Nevada County Ca

States That Don T Tax Social Security

State W 4 Form Detailed Withholding Forms By State Chart

The Student Loan Forgiveness Application Is Live But Will You Owe Taxes On Debt Relief Cnet

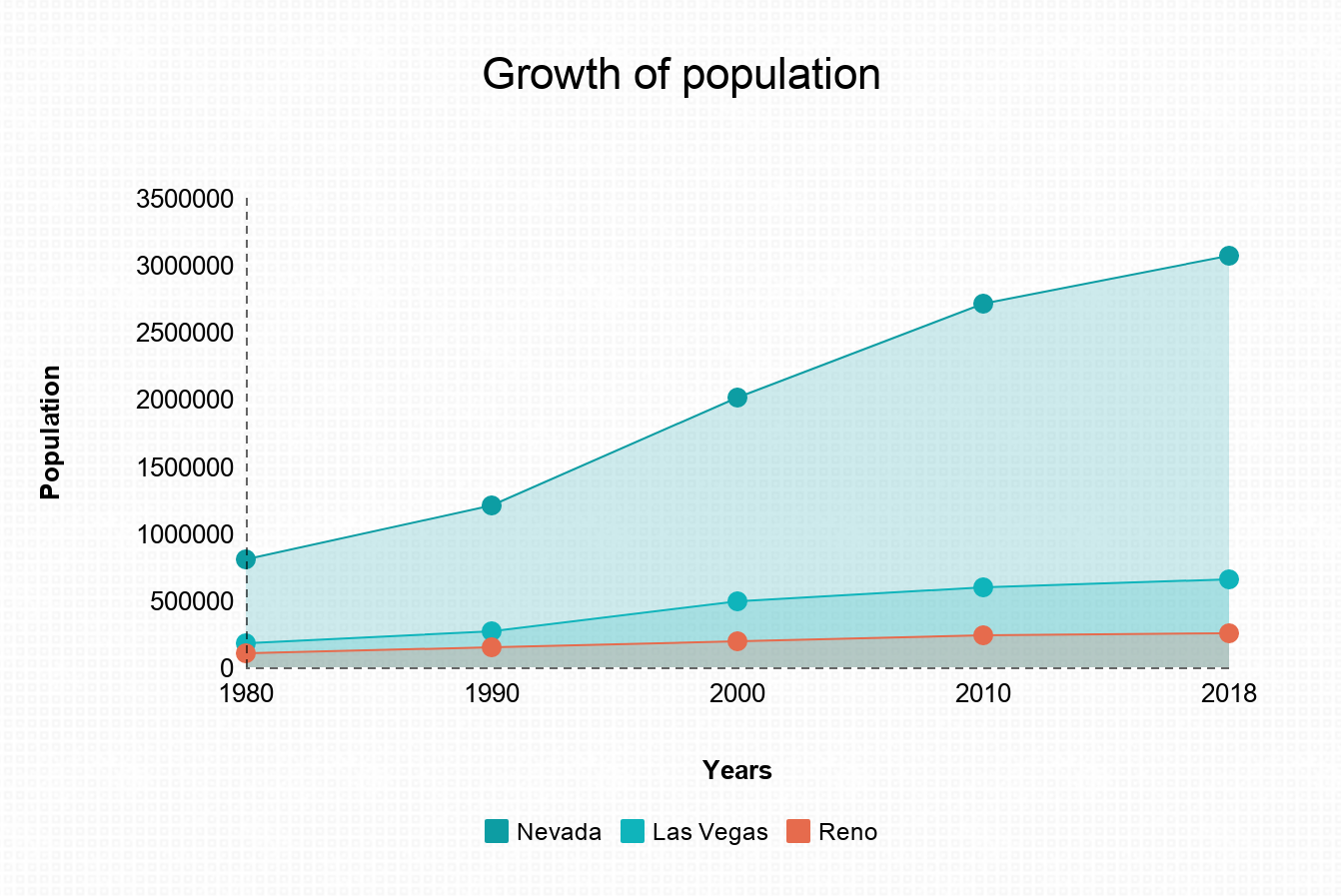

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Taxes In Nevada U S Legal It Group

Taxation In California Wikipedia

Is Moving To Nevada Right For You A 2022 Guide Bellhop

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Taxes And Moving To A New State Turbotax Tax Tips Videos

Want To Pay Lower Cell Phone Taxes Move To Oregon Geekwire

Do You Pay State Income Tax Where You Live Or Work Optima Tax Relief

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company